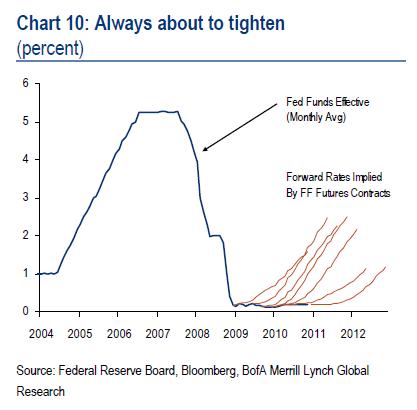

While this blog is not intended to offer much in the way of macro commentary, it appears obvious to me that the only place for rates to go is up. While there are numerous factors that affect interest rates, when they remain low for long enough it creates many of the reason such as inflation or economic growth. Japan over the past two decades has proven an exception to this rule. I say rule, because such things are meant to be broken. According to this post from The Big Picture, it appears I am not alone in believing interest rates will rise. Interestingly enough though, people have thought they would rise eventually for the past 2 years:

The market has been expecting that rates would rise by the end of the year for quite some time now. It appears that the expected degree of the increase is now expected starting at the end of 2011 but starting a sustained march upwards in 2012. Timing is a bitch. As it applies to the aforementioned investments I've discussed, such timing is not an issue. Things would only get worrisome if a rate increase was the result of really rampant inflation starting to kick in a la hyperinflation.

The market has been expecting that rates would rise by the end of the year for quite some time now. It appears that the expected degree of the increase is now expected starting at the end of 2011 but starting a sustained march upwards in 2012. Timing is a bitch. As it applies to the aforementioned investments I've discussed, such timing is not an issue. Things would only get worrisome if a rate increase was the result of really rampant inflation starting to kick in a la hyperinflation.From a general viewpoint, waiting on interest rates to rise for an extended period of time would really eat into return. In the case of PMC Commercial Trust, interest rates can remain low, but an investor will still receive a satisfactory return. As with Bank of Internet, while they benefit from the current ZIRP, the outsized profits they currently generate are compressing the time frame of their next phase of growth and increasing their normalized earnings as assets that generate income increase.

Talk to Andrew about interest rates

No comments:

Post a Comment